SP500 LDN TRADING UPDATE 4/2/26

SP500 LDN TRADING UPDATE 4/2/26

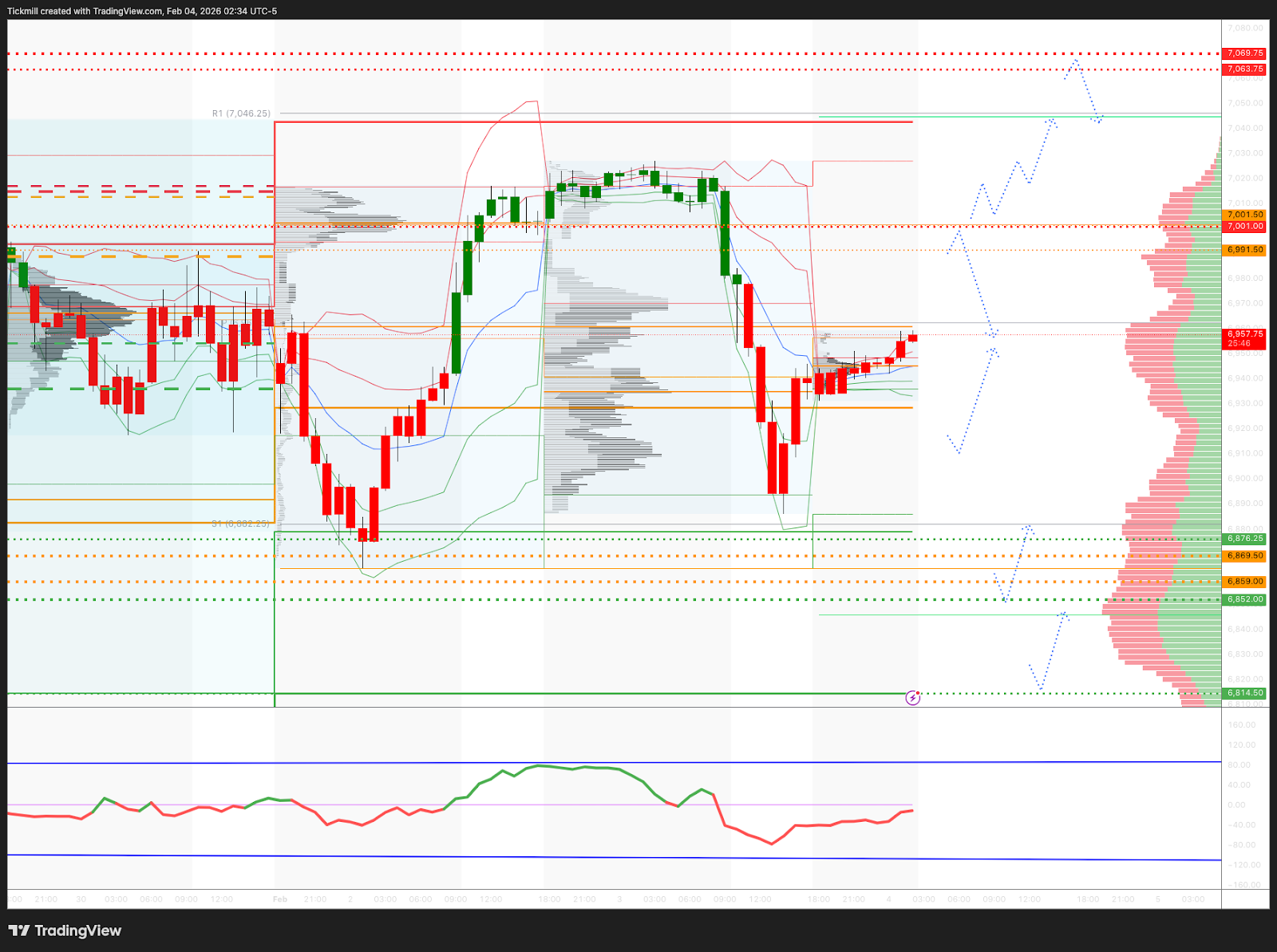

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6859/69

WEEKLY RANGE RES 7058 SUP 6869

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

GAMMA FLIP LEVEL 6962

DAILY VWAP BEARISH 6974

WEEKLY VWAP BULLISH 6962

MONTHLY VWAP BULLISH 6896

DAILY STRUCTURE – BALANCE - 7031/6886

WEEKLY STRUCTURE – BALANCE - 7031/6822

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6822

DAILY BULL BEAR ZONE 6991.5/7001.5

DAILY RANGE RES 7001 SUP 6876

2 SIGMA RES 7063 SUP 6814

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.26 (The numbers reflect options traded during the current session. A put-call ratio below 0.7 is generally considered bullish, and a put-call ratio above 1.0 is generally considered bearish)

TRADES & TARGETS

SHORT ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET 6950 > 6910

LONG ON REJECT/RECLAIM 6910 TARGET 6950 > DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “Painful”

S&P closed down 84bps at 6,918 with a Market-on-Close (MOC) of $2.3bn to buy. The NDX fell 155bps to 25,339, while the R2K gained 31bps to 2,648. The Dow slipped 34bps, closing at 49,241. A total of 23.56 billion shares traded across all US equity exchanges, significantly above the YTD daily average of 19.12 billion shares. The VIX spiked +10.28% to 18.02, WTI Crude surged +311bps to $64.07, the US 10-Year Treasury yield dipped 1bp to 4.27%, gold soared +635bps to $4,958, the DXY dropped 28bps to 97.36, and Bitcoin fell 226bps to $76,685.

It was a turbulent day with sharp declines across major indices and TMT sectors, driven by rising concerns surrounding the OpenAI ecosystem. What began as a year-long de-grossing in Software has now extended into pockets of Financials (Alts/BDCs), triggering a broader rotation out of the Tech sector. This included pressure on Semiconductors, Internet stocks, and the "Mag 7." Geopolitical tensions between the US and Iran further exacerbated the selloff following midday headlines.

Software saw a steep decline of -4.8%, influenced by several factors: 1) Anthropic's release of new capabilities for its agentic Cowork facility, 2) weak earnings reports from multiple AI-exposed companies, 3) a momentum-driven rally weighing on software, and 4) underwhelming performance from PLTR, which ended "only" +5% despite a substantial beat/raise. Subsector price action and trading desk flows suggest continued rotations into sectors like Materials, Energy, Industrials, Utilities, and Staples, as investors seek more stable narratives and price action. Notably, transports and trucking names such as SAIA, ODFL, and JBHT have emerged as top picks on our desks.

Activity on the trading floor was rated an 8 out of 10. The floor ended the day -860bps for sale versus a 30-day average of -52bps. Asset managers were net sellers by $2 billion, driven entirely by Tech. Hedge funds also net sold $2 billion, marking the highest sell skew since September 1, ranking in the 97th percentile over a 52-week period. Hedge funds primarily sold Tech, Consumer, and Macro, with smaller buying interest in Financials.

Post-market, AMD fell 5% despite beating revenue and gross margin estimates, as it guided Q1 revenue slightly above consensus but down ~4.5% quarter-over-quarter. TTWO rose 4% after raising its FY guidance, increasing FY EPS to $3.75-$3.85 (from $3.05-$3.30) and net bookings to $6.65-$6.7 billion, while guiding Q4 net bookings to $1.51-$1.56 billion (vs. consensus of $1.54 billion).

On the derivatives front, there was significant downside movement with both volatility and skew bid across the surface. Early in the day, the software-led selloff saw limited panic, with flows leaning toward rolling out and monetizing hedges. However, as the market declined further on Iran and government shutdown headlines, more participants stepped in to fade the term structure and skew moves. Interestingly, while the selloff was concentrated in Tech, the NDX skew remained relatively stable. Software supply was largely driven by long-only flows, with positioning at all-time lows. Attention remains on Tech, with AMZN earnings scheduled for tomorrow and GOOGL on Thursday. AMZN’s straddle closed at ~68bps for tomorrow, while the end-of-week straddle priced at ~125bps.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!