FTSE 100 FINISH LINE 6/11/25

FTSE 100 FINISH LINE 6/11/25

The FTSE is set to close the session in negative territory as the Monetary Policy Committee (MPC) opted to maintain the Bank Rate at 4.00% during its November meeting, a decision closely aligned with market consensus expectations. The outcome was narrowly decided, with the motion to keep rates unchanged passing by a slim 5-4 majority. This marks a break from the quarterly rate-cutting cycle the MPC has followed since its initial reduction last August. However, the committee acknowledged that further disinflation could prompt additional cuts in the future. As such, the November decision should not be viewed as a significant shift in monetary policy direction or an end to rate reductions. Instead, it reflects the MPC’s effort to counteract the recent uptick in inflation expectations. The sluggish growth of the UK economy has raised concerns about its resilience, especially as inflation remains well above the Bank of England's 2% target. This situation has historically resulted in high interest rates in the UK, which have subsequently hindered growth expectations. Nevertheless, the Bank of England's recent position has eased concerns among inflation advocates, at least for now, as market predictions lean towards a possible rate reduction in December—coinciding with the potential for the Federal Reserve to also lower rates. Looking further ahead, projections show the Fed and BoE likely following similar rate trajectories in 2026. The LSEG’s IRPR indicates that the Fed may cut rates by an additional 81 basis points by its December 2026 meeting, while the BoE is expected to reduce rates by 61 basis points over the same period.

AstraZeneca's stock increased by 3.1% to 128.36 pounds ($172.27) during the late session after the company confirmed its margin forecast for 2026, stating it can manage the consequences of the U.S. drug pricing agreement. The shares are among the leading gainers on the FTSE 100 index, following a period of subdued trading earlier in the day after the release of its Q3 results. Finance Chief Aradhana Sarin expressed confidence in the company's ability to absorb the financial impact of the deal to reduce prices on some prescription drugs in the U.S. The company reiterated its annual revenue and core earnings forecasts, affirming that it expects core operating margins to be in the mid-30s percentage range by 2026. In Q3, AstraZeneca reported core earnings of $2.38 per share and revenue of $15.19 billion, exceeding market expectations according to a company survey. With today's gains, the stock has risen by 22.3% year-to-date, compared to a 19.2% increase in the FTSE 100 index.

BT Group, the largest broadband and mobile provider in Britain, saw its shares rise by 2.9% to 185.2p, making it one of the top performers on the FTSE 100 index. The company has expanded its fibre rollout to 20.3 million in the first half of the year, which is expected to help achieve free cash flow targets of £2 billion ($2.68 billion) by March 2027 and £3 billion by the end of the decade. Additionally, BT Group has increased its interim dividend to 2.45 pence and reaffirmed its forecasts for the full year 2026 and medium-term goals. The company reported a core profit of £4.13 billion for the six months ending in September, fuelled by cost-cutting initiatives and heightened demand for faster connections via its Openreach division. BT's shares remain an attractive investment, with capital expenditures reaching a peak and robust cash flow anticipated in the coming years. Year-to-date, the stock has increased by 28.6%, outperforming the FTSE 100 index, which has risen by 19.2%.

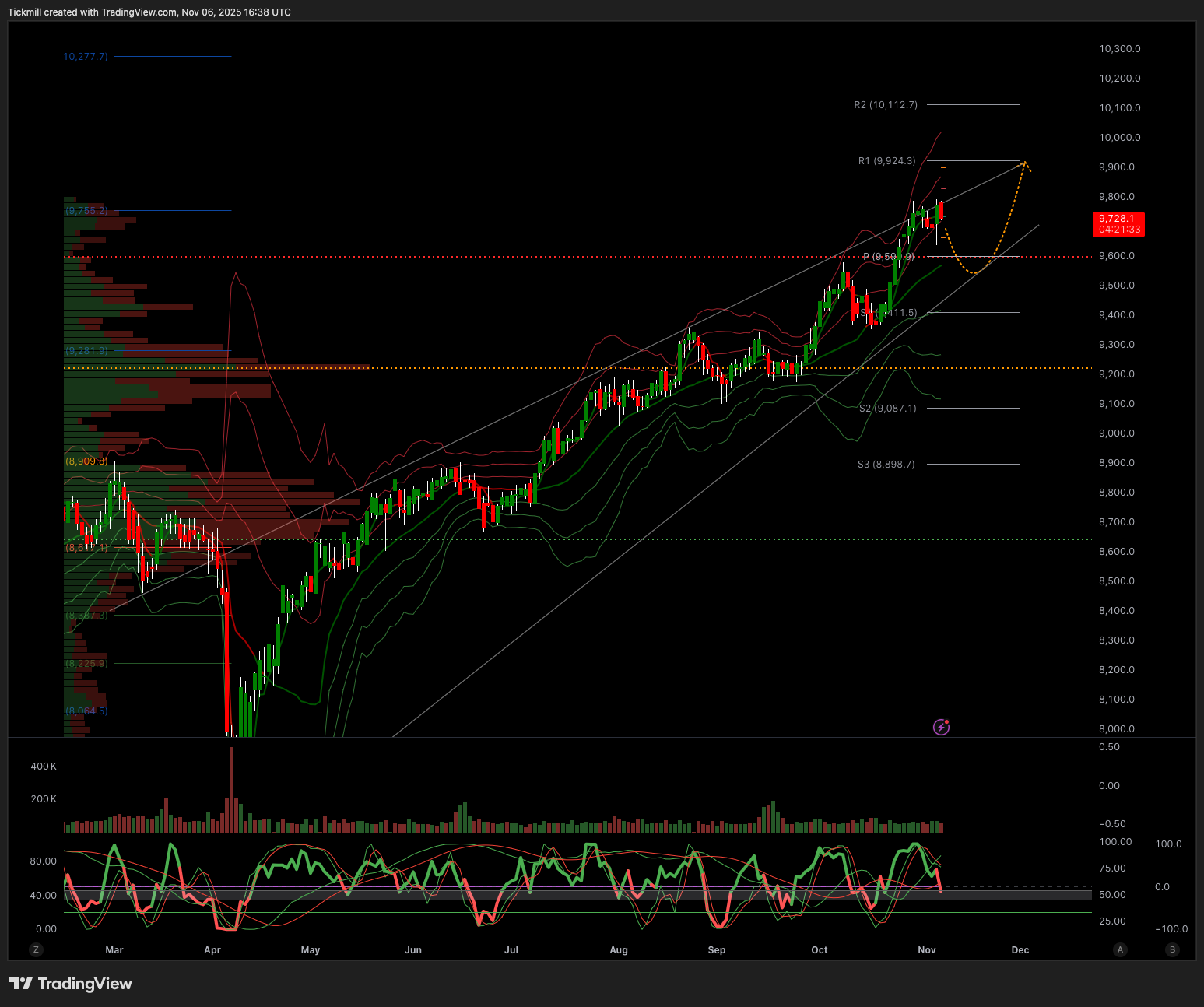

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bearish 9730

Weekly VWAP Bullish 9555

Above 9730 Target 9868

Below 9730 Target 9602

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!