Gold Soaring As USD Tanks on US Data Expectations

Gold Pushing Higher Again

Gold prices are soaring higher on Thursday with the futures market back above the 4,200 level and retest of YTD highs in coming sessions. Fresh USD weakness in response to the ending of the record-long US govt shutdown has helped drive fresh demand for gold. The futures market is up almost 6% this week with four straight days of gains and shows no signs of slowing down. With the compromise bill passing through the House yesterday and signed into law by President Trump, the US govt funding has been restored and federal services are reopened. The focus now is on all the delayed data to come from over the shutdown period with headline focus on labour market and inflation data readings.

Dovish Data Expectations

The sell off in USD suggests that traders ware wary of fresh downside in these readings which should reboot December easing prospects. At the last FOMC meeting, Fed chair Powell warned that a December cut was not a done deal, citing uncertainty and division among policymakers given the lack of data available during the shutdown. However, with the delayed data due to come in the next week or so, this should clearly signal to traders how likely a further cut is.

NFP in Focus

If the two delayed NFP reports show weakness, this alone should be enough to cement a furtehr cut, keeping USD pressured lower near-term while gold prices should break out to fresh highs. As yet there has been no signal on when this delayed data is likely to arrive so traders will be watching for details on this schedule, though we should start seeing readings come through next week.

Technical Views

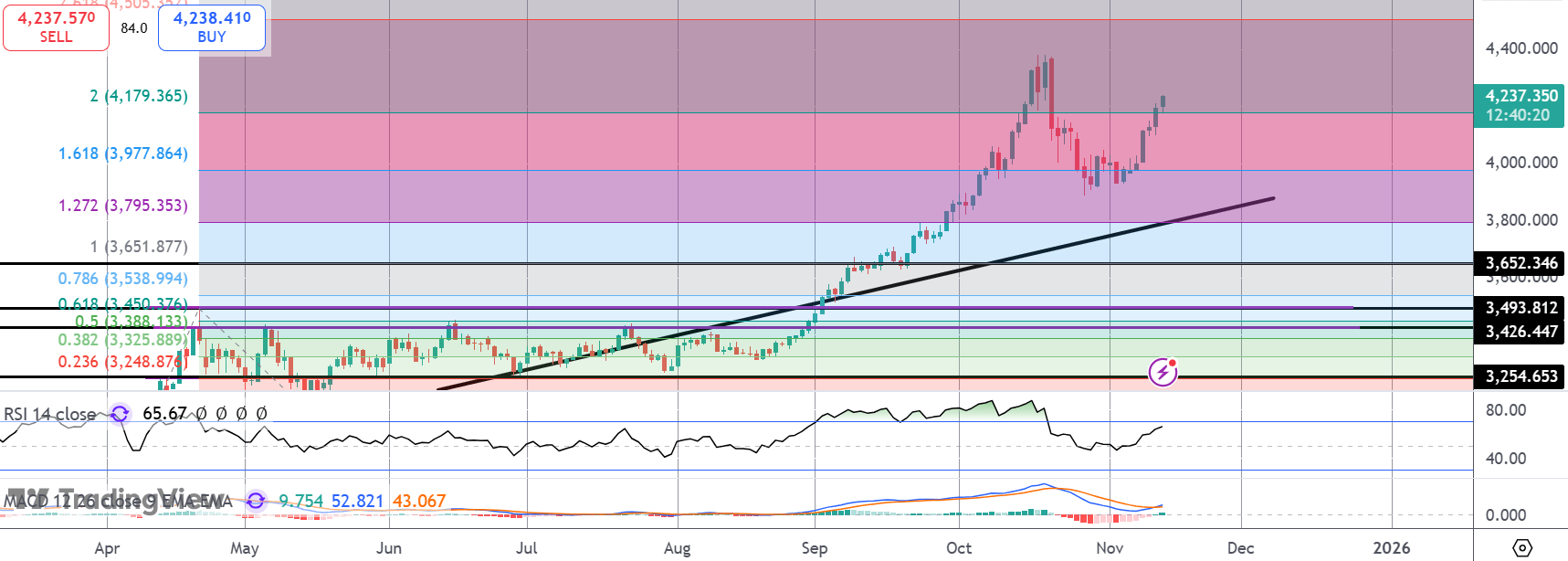

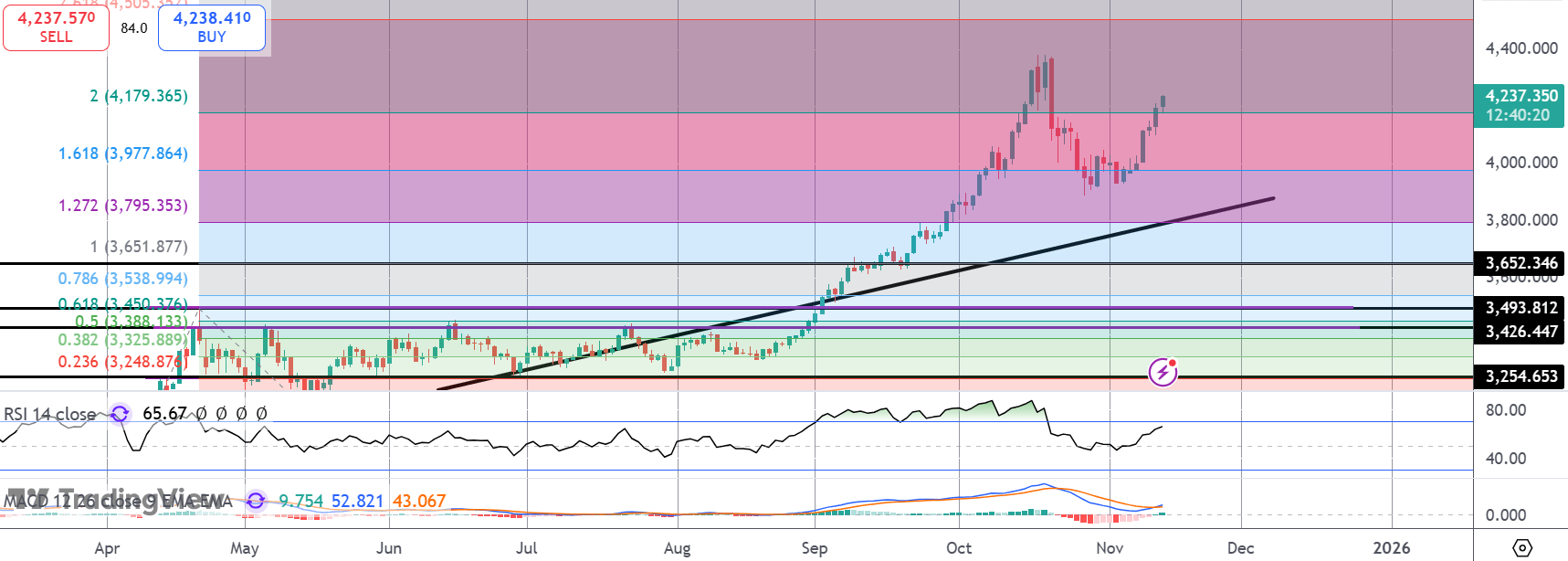

Gold

Gold prices have rallied firmly out of the corrective consolidation around the 4k mark. Price is now back up above the 4,200 level and look set for a fresh test of YTD highs soon with the 2.618% Fib level at 4,505.35 the next target for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.