Institutional Insights: Deutsche Bank FX ´Market Adds To USD Shorts'

Market Adds to USD Shorts Despite Pause in Weakening Momentum

The "debasement trade" has lost traction since Kevin Warsh's nomination as Fed Chair, temporarily halting the dollar's weakening trend. Despite this pause, market participants are capitalizing on the opportunity to increase USD short positions, particularly across G10, CEEMEA, and select Asian currencies, including CNH.

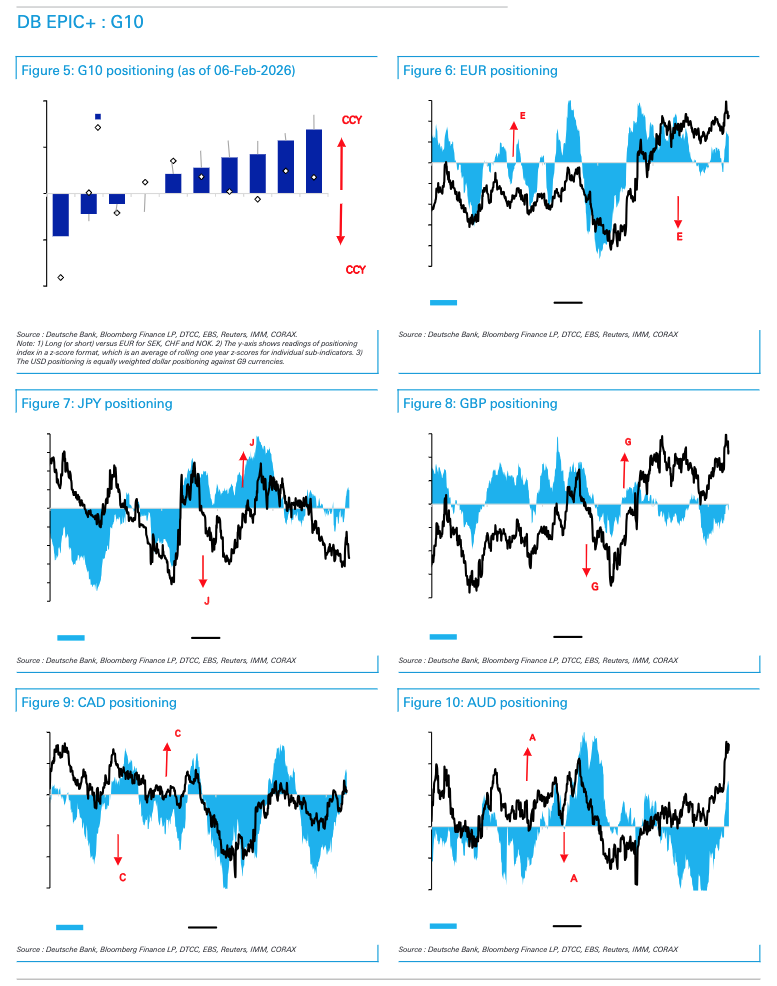

G10 Currencies: Shifts in Positioning

Over the past two weeks, G10 currency markets experienced notable positioning shifts:

- EUR: Long exposure to the euro increased significantly, likely driven by both systematic and discretionary hedge fund buying, as highlighted in the recent CORAX report.

- GBP: Short positions in the pound were reduced.

- JPY: Long positions in the yen saw a substantial rise.

- CHF: Short positions in the Swiss franc were significantly pared back.

- AUD & NZD: Both currencies experienced an increase in long exposure. The outlook for the Australian dollar remains positive, supported by rising interest rates due to robust inflation and strong economic growth.

- CAD: A moderate shift to long positions was observed in the Canadian dollar.

- NOK & SEK: Long positions in Norwegian krone and Swedish krona were moderately reduced.

Asian Currencies: Diverging Trends

Asian currencies displayed a more nuanced picture:

- CNH: The Chinese yuan has become the region's largest long position, though its positioning remains far from stretched, reducing risks for existing longs. Discretionary hedge fund 3-month rolling flows are at just 30% of their late-2024 peak, suggesting room for further accumulation. Systemic hedge funds are cutting CNH shorts, while real money investors are actively building longs. Corporate CNH buying continues but at a slower pace ahead of the Chinese New Year.

- KRW: Short positions in the South Korean won were initially added but later pared back. Proprietary flow data shows a sharp divergence among investors: discretionary hedge funds have aggressively bought KRW, with the 3-month rolling sum reaching 69% of its June 2025 peak, while corporates and banks (retail flow proxies) are heavily selling KRW.

- IDR: The Indonesian rupiah demonstrated resilience despite recent negative headlines. Asset managers and systemic hedge funds have mostly unwound their short positions, while discretionary hedge funds opened new shorts since January.

- Other Asian Currencies: SGD longs were reduced, while INR saw light additions to long positions. Shorts in TWD and PHP were trimmed, but THB shorts were increased.

CEEMEA Currencies: Shifting Dynamics

In CEEMEA markets:

- CZK & HUF: Both shifted from small short positions to net longs.

- PLN & TRY: Long positions increased notably.

- RUB: Extended longs in the Russian ruble now represent the largest long position in emerging market currencies.

- ZAR & ILS: Long positions in the South African rand were notably reduced, while shorts in the Israeli shekel were extended.

LatAm Currencies: Adjustments in Positioning

In Latin America:

- BRL: Short positions in the Brazilian real were pared back to flat.

- PEN: The Peruvian sol saw a dramatic shift from being the largest short position in emerging markets two weeks ago to a small long.

- CLP & COP: Short positions in the Chilean peso and Colombian peso were extended.

- MXN: Mexican peso shorts were modestly reduced.

We maintain a bullish outlook on CLP, BRL, and MXN, supported by a favorable external environment, strong terms of trade, and cautious central bank policies. Central banks such as BCB, Banxico, BCCh, and BCRP remain on hold, while BanRep has hiked rates more than anticipated.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!